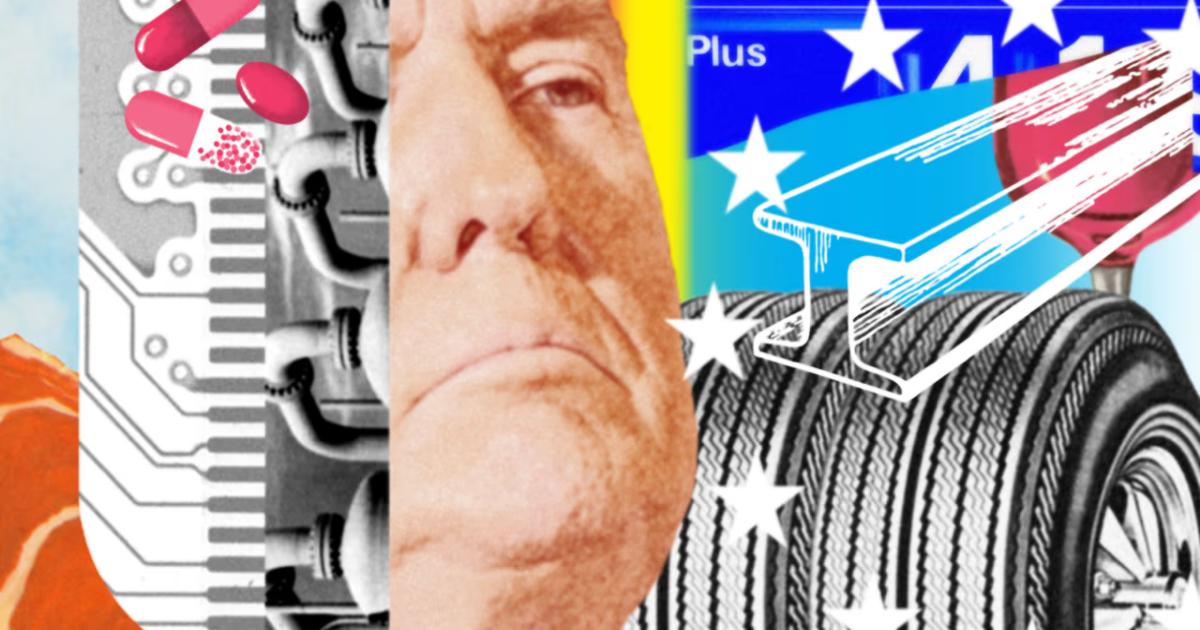

The trade war is coming for two of the biggest names in the semiconductor industry—and that’s unnerving markets.

Nvidia, the third-largest U.S. company by market value, warned late Tuesday that it will take a $5.5 billion charge after the U.S. said it will need a license to export H20 processors to China and other countries. These less-powerful AI chips had been designed to comply with American export controls.

Another industry linchpin also rattled investors. ASML, whose huge, costly machines are needed to make the most advanced chips, reported much weaker-than-expected orders and warned about tariff-related disruption.

Nvidia stock sank premarket, as did AMD, while ASML shares fell in Amsterdam. The moves rippled across global markets, with Nasdaq-100 futures losing more than 1%. Major indexes in Europe and Asia also declined.

Wall Street’s fear gauge, the Cboe Volatility Index, jumped after falling for three trading days. The dollar, meanwhile, extended its stretch of weakness.

Beijing named a new top trade negotiator, a former ambassador to the World Trade Organization. And new data Wednesday showed China’s economy grew 5.4% in the first quarter on the year, matching the pace of the previous quarter. Growth was partly driven by exports, which rocketed as U.S. importers raced to bring in orders ahead of anticipated new tariffs.