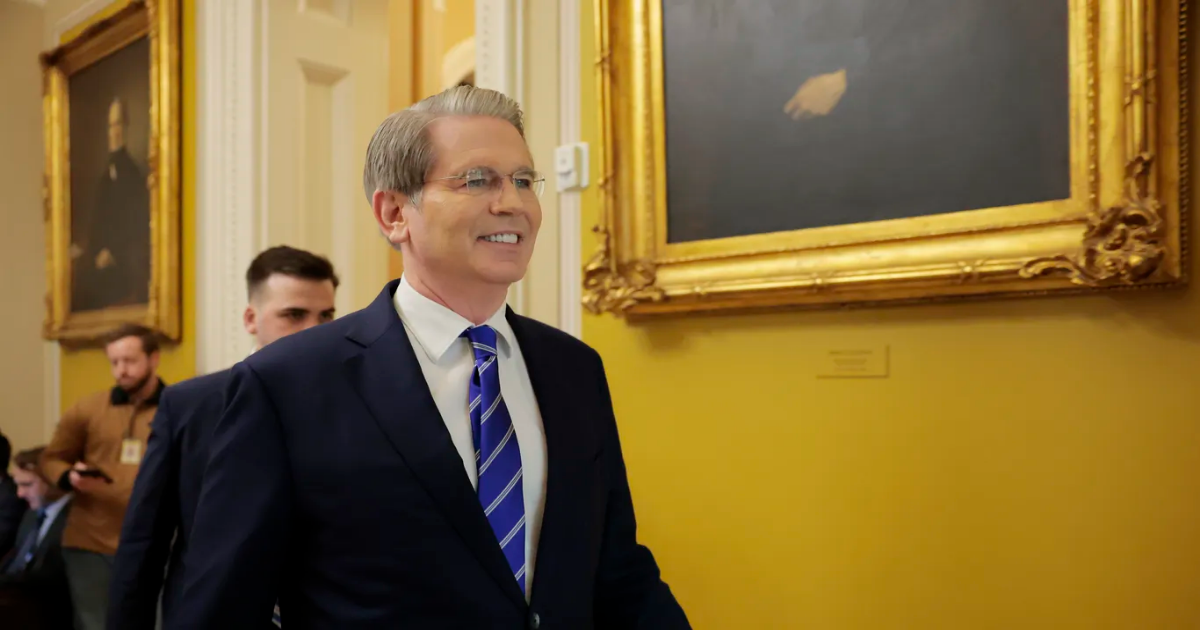

Americans will benefit more from lower energy prices and interest rates than they will be hurt by falling stock prices as a result of President Trump‘s tariffs, Treasury Secretary Scott Bessent said Sunday.

Why it matters: Economists broadly fear a global recession, perhaps even a dire stagflationary environment of rising prices and slowing growth, after Trump’s sweeping attempt to re-order the world’s economy.

What they’re saying: “Oil prices went down almost 15% in two days, which impacts working Americans much more than the stock market does. Interest rates hit their low for the year, so I’m expecting mortgage applications to pick up,” Bessent told “Meet the Press” host Kristen Welker.

By the numbers: Stocks fell more than 10% Thursday and Friday, wiping out more than $6 trillion in investor assets. But Bessent was adamant the economy will hold up.

- “I see no reason that we have to price in a recession,” he said.

- He also insisted that the day-to-day gyrations of the market weren’t relevant over the long term, even for people nearing retirement now.

- “Americans who have put away for years in their savings account … don’t look at the day-to-day fluctuations of what’s happening,” he said.

- Research shows the majority of American households own stocks, either directly or in mutual or retirement funds.

Zoom out: Both Bessent and National Economic Council director Kevin Hassett downplayed the risk of inflation in interviews Sunday, despite widespread predictions it could surge.

- “I don’t think you’re going to see a big effect on the consumer,” Hassett said on ABC’s “This Week,” though he also acknowledged “there might be some increase in prices.”

The intrigue: Repeatedly pressed by Welker, Bessent refused to suggest any chance the tariffs could be lifted or negotiated away, saying Trump had created “maximum leverage for himself.”

- “I think we’re going to have to see what the countries offer and whether it’s believable, Bessent said. “We are going to have to see the path forward. After 20, 30, 40 years of bad behavior, you can’t just wipe the slate clean.”

- Markets have been hopeful that there could be some kind of pause, or relief, before the retaliatory tariffs go into effect Wednesday.

- Billionaire hedge fund manager Bill Ackman, a Trump supporter, posted Saturday that a pause before Monday’s market open made sense and that the world risked a potentially severe recession without one.

Editor’s note: This is a developing story and will be updated with more information.