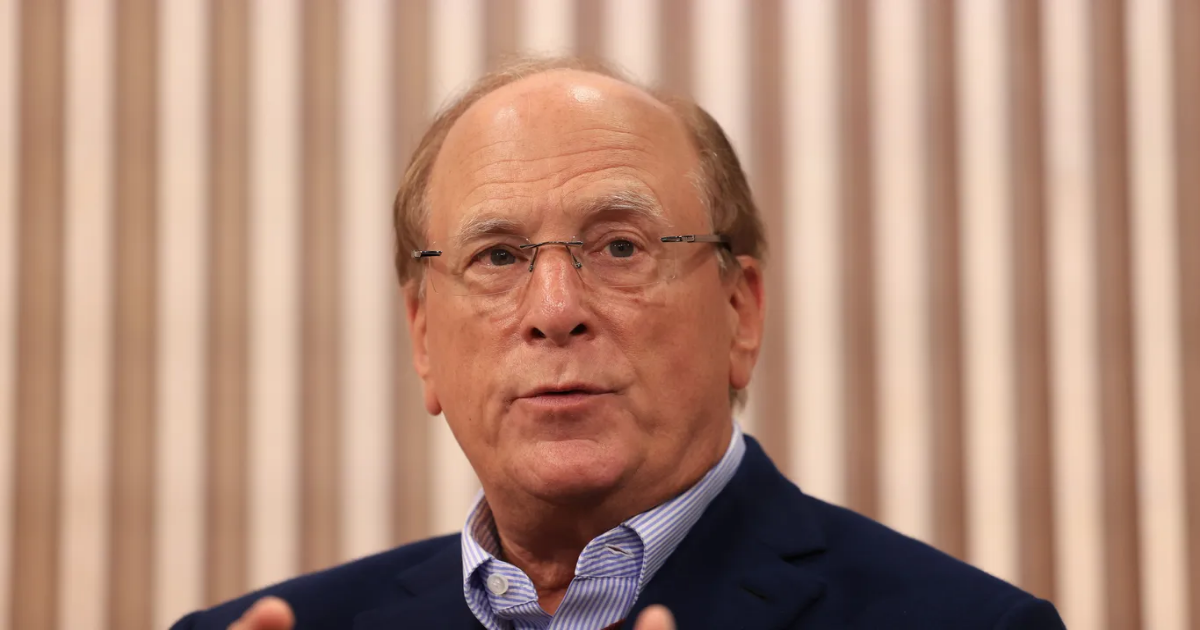

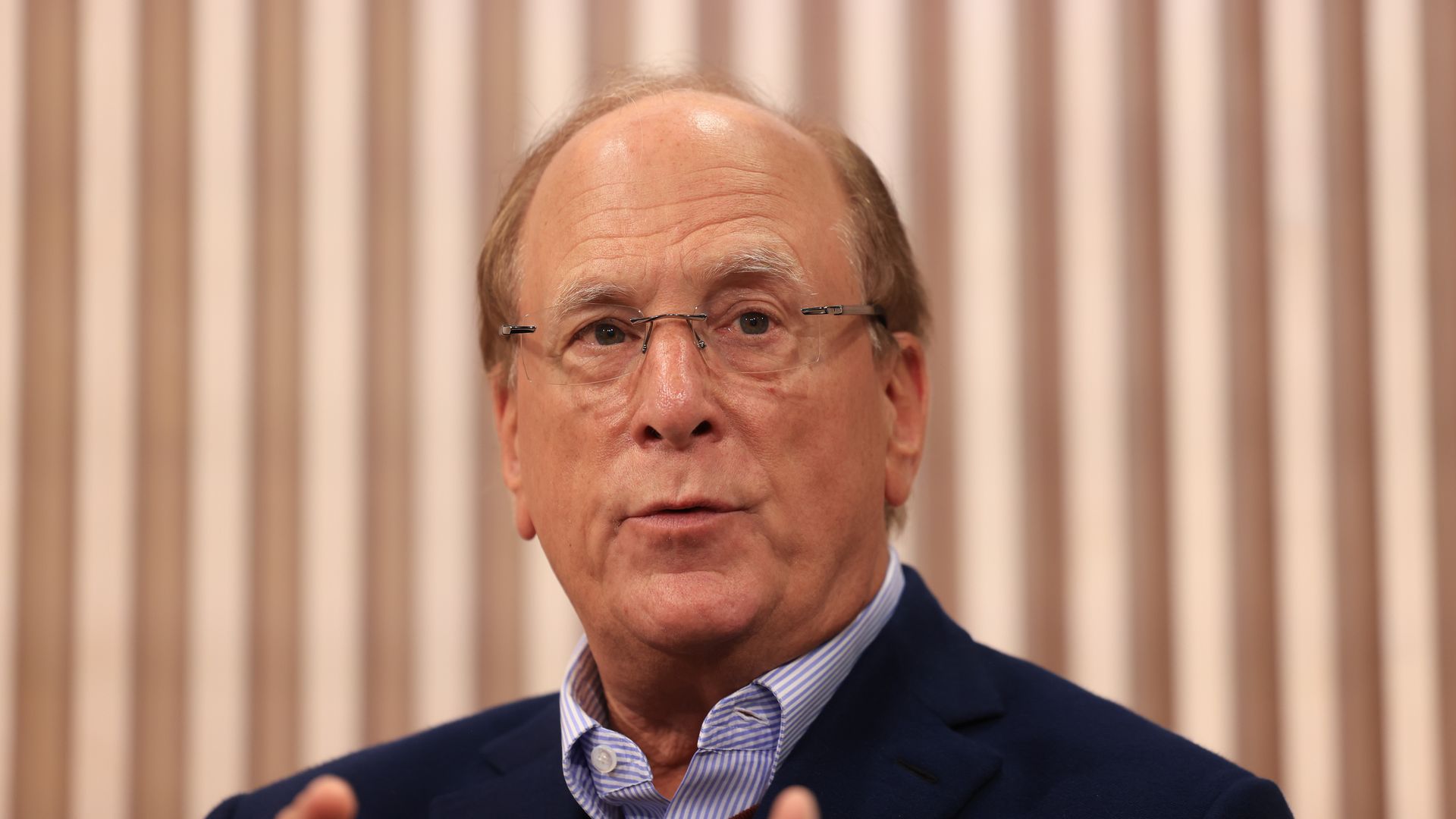

BlackRock CEO Larry Fink warned on Monday that most chief executives would say the U.S. economy is currently in a recession.

Why it matters: Fink, who has extensive CEO contacts as head of the world’s largest asset manager, is the latest billionaire to acknowledge the risks of economic turmoil from President Trump’s trade wars.

- Fink spoke after Trump threatened to further hike tariffs on Chinese goods by an additional 50% if Beijing did not remove previously announced retaliatory levies.

What they’re saying: “Most CEOs I talk to would say we are probably in a recession right now,” Fink said during a lunchtime appearance at the Economic Club of New York on Monday, according to Bloomberg.

- “One thing I would say for sure right now is the economy is weakening,” Fink said.

- Fink also added that the inflationary risk of White House trade policy might be much greater than financial markets believe.

Between the lines: Global financial markets continued to plunge on Monday, with lower oil prices and government bond yields signaling that fears about an economic slowdown have taken hold.

- Top economists from Goldman Sachs and JPMorgan are ramping up odds that the U.S. will enter a recession this year — though no major bank has said one is already underway.

What to watch: The semi-official arbiter of recessions is a committee of private academics at the National Bureau of Economic Research, though CEOs tend to call out signs of economic soft patches much sooner.

- The labor market continued to expand at a healthy rate last month, with 228,000 jobs added — usually a hint of an economy in solid shape.

- But those go-to indicators might be too stale in Trump’s fast-changing trade policy environment, which might push businesses to slow hiring or consumers to pause spending.