Eli Lilly on Thursday reported promising results for a daily pill that could serve as an alternative to injectable weight-loss and diabetes drugs.

Why it matters: One thing hampering the GLP-1 drug boom is the fact that they’re shots — not oral medications — which keeps some prospective patients from taking them.

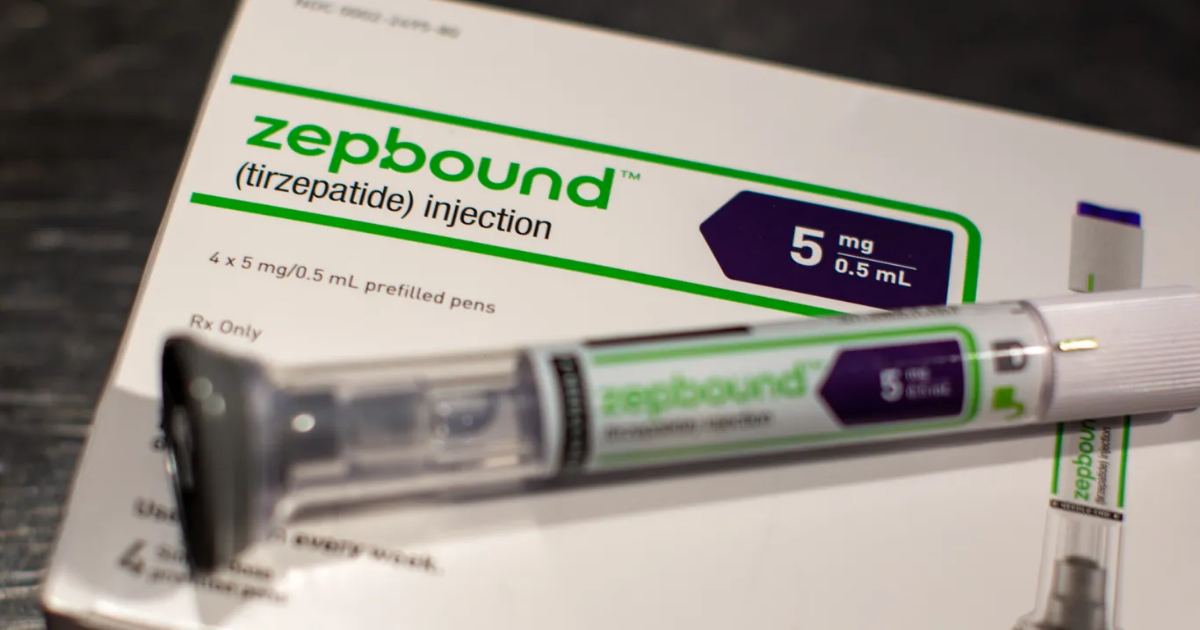

Between the lines: Lilly — which makes the diabetes drug Mounjaro and the weight-loss treatment Zepbound — reported positive Phase 3 trial results for the oral medication orforglipron.

- Depending on the dosage, the drug delivered weight loss in diabetes patients of up to 7.6% over 40 weeks, compared with a placebo’s 1.7%. People without diabetes are expected to lose more weight on the drug.

- Patients in the study were still losing weight when the trial period ended for the drug, which can be taken without food and water restrictions. It also led to a dramatic blood-sugar reduction in diabetes patients.

- And the drug “meets our expectations for safety and tolerability,” matching injectable GLP-1 drugs’ safety profile, Lilly CEO David Ricks said in a statement.

What they’re saying: “The data are pretty much a best-case scenario, in our view — on weight loss, blood sugar control, tolerability, safety,” Bank of America analyst Tim Anderson wrote Thursday in a research note.

The impact: Experts agree a pill version of GLP-1 drugs — which a number of pharmaceutical companies have been chasing — could blow open the door to more users.

- “The demand is great, and it would be so much easier for people to take than using the injection,” Marianne Udow-Phillips, a health industry consultant and senior adviser to the University of Michigan Center for Health and Research, tells Axios.

The big question: What will it cost?

- GLP-1 treatments can cost up to $1,349 per month without insurance — and many plans don’t cover them for weight loss, including Medicare.

- “If the price were to come in lower, I think more employers would cover the medications and make it available to more people,” Udow-Phillips said of a pill version.

What we’re watching: Drug giants have been scrambling to boost production of GLP-1 medicines to meet demand after experiencing shortages in recent years due to soaring usage.

- It was not immediately clear whether factories built to make injectable GLP-1 treatments can be easily converted to manufacture pills.

- But Ricks said that orforglipron “if approved, could be readily manufactured and launched at scale for use by people around the world.”

Zoom out: The positive results sent Lilly’s stock soaring 16% Thursday to $852.

- Bank of America’s Anderson projected 2030 sales of $10 billion.

- The company’s GLP-1 rival, Novo Nordisk, maker of Ozempic and Wegovy, saw its stock fall 7%.

Yes, but: There’s no guarantee orforglipron makes it to the market.

- Pfizer said Monday that it’s discontinuing development of its own oral GLP-1 drug after a patient in a clinical trial suffered a liver injury that may have been connected with the treatment.

What’s next: Lilly said it expects to deliver further results this year and to request regulatory approval for the drug for weight management in 2025 and for diabetes treatment in 2026.