India-West News Desk

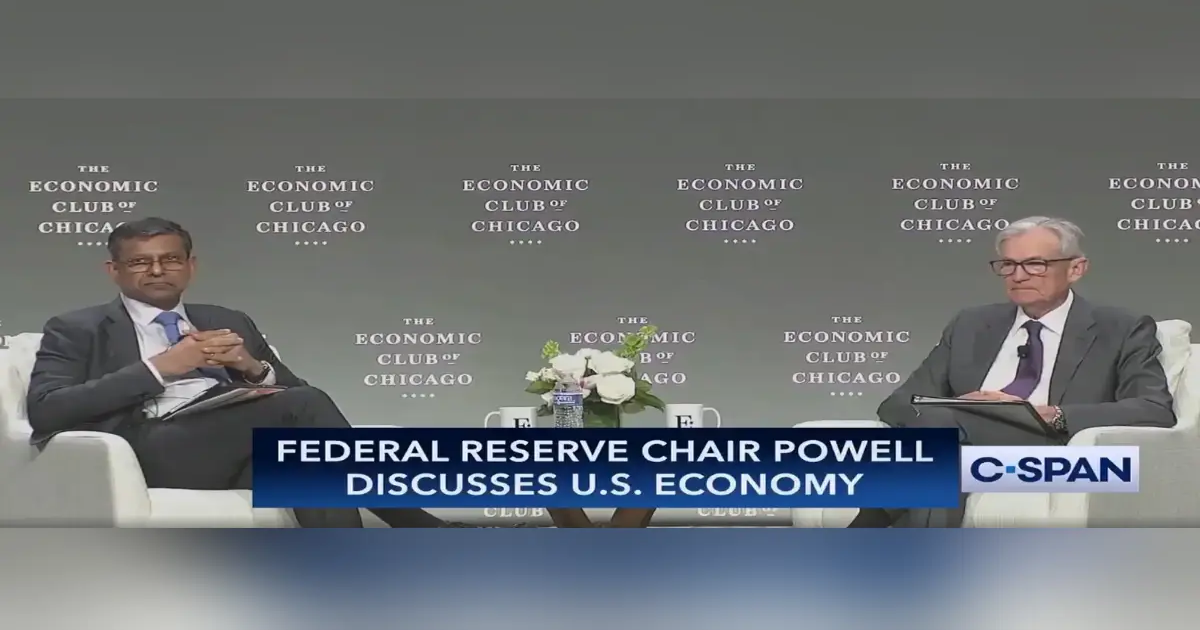

CHICAGO, IL — When Raghuram Rajan posed the question—calmly, precisely, and with a touch of professorial concern—the air in the room seemed to shift. “Should one worry about threats to the Fed’s independence once you’re gone?” the University of Chicago professor asked Jerome Powell at the Economic Club of Chicago on April 16.

The question hit a nerve not only because of its source—Rajan, a globally respected economist and former Reserve Bank of India governor—but also because it came at a moment when the stakes for monetary policy in the U.S. couldn’t be higher. Markets, already uneasy, sank further as Powell warned of economic turbulence and inflationary pressure driven in part by President Donald Trump’s aggressive tariff regime.

Investors, rattled by Powell’s gloomy assessment and his pledge to pause further rate hikes, stepped up their selloff. The Fed chair made clear that Trump’s tariffs were both “larger than expected” and without clear historical precedent—remarks that, according to Reuters, added to concerns that the U.S. economy is headed for slower growth and rising prices.

“Generally speaking, Fed independence is very widely understood and supported in Washington, in Congress, where it really matters,” Powell told Rajan and the audience, drawing applause. “We’re never going to be influenced by any political pressure.”

Powell emphasized that the central bank would continue to make decisions based solely on data and its dual mandate—maximum employment and price stability. “Our independence is a matter of law,” he said. “We serve very long terms. Seemingly endless terms.”

But that legal insulation hasn’t stopped President Trump from attempting to upend the Fed’s authority—and Powell’s leadership. Just a day later, on April 17, Trump lashed out on social media, declaring Powell’s removal “cannot come fast enough.” The president also derided Powell’s Chicago speech as “another, and typical, complete mess!”

Trump’s increasingly open frustration with the Fed chair, who he had appointed to office, comes amid broader efforts to exert control over other independent agencies, efforts now facing scrutiny in the U.S. Supreme Court. He has repeatedly pressured the central bank to cut interest rates, despite Powell’s insistence that the Fed will remain apolitical.

In his April 16 speech, Powell argued that Trump’s trade policies could push inflation and employment further from the Fed’s goals. Fed officials have gone as far as to characterize the tariffs as an economic “shock” with no clear historical comparison, Reuters reported.

Economists are taking note. A Reuters poll now puts the odds of a U.S. recession at 45%, reflecting the fragile balance between inflation concerns and declining growth. New York Fed President John Williams, speaking on April 17, confirmed that view, saying, “We have a period of higher inflation this year and a slower growth path.”