Gold is the undisputed winner from this month’s market turmoil.

The precious metal, coveted in times of uncertainty and stress, surged again early Tuesday to a record high, topping $3,500 a troy ounce. Another haven asset, the Japanese yen, also rallied.

U.S. shares, however, look poised for a rebound, after the S&P 500 fell 2.4% Monday. Futures tied to the benchmark gained 1% early Tuesday. And major tech stocks rose premarket, after being hit hard in the previous session.

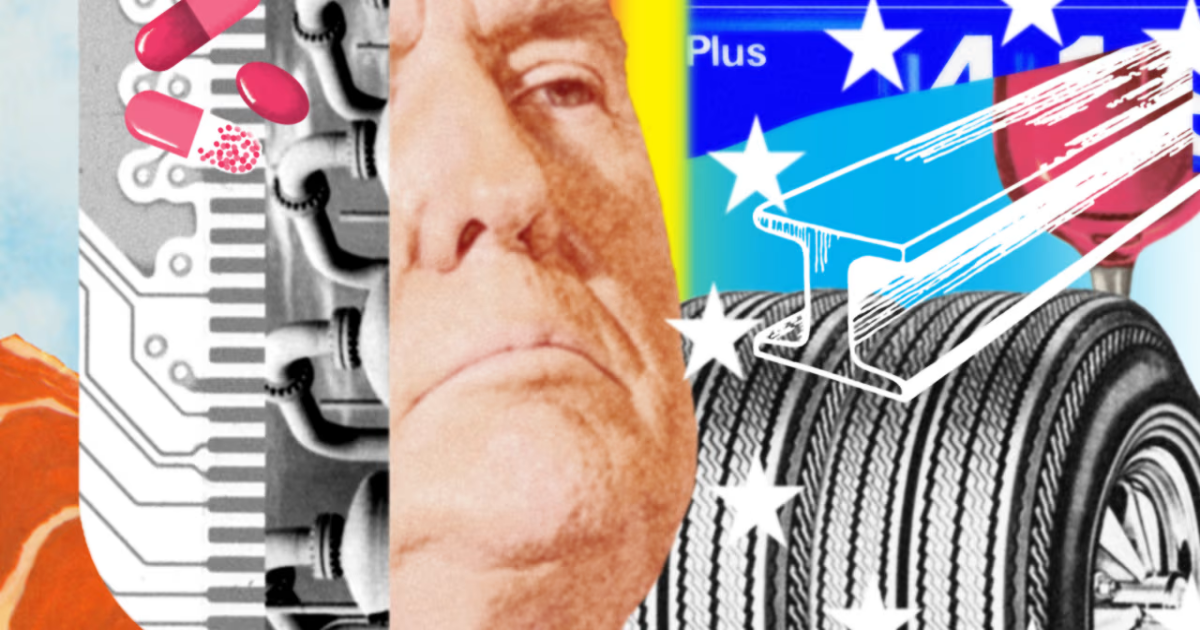

Investors’ concerns over President Trump’s trade war and his threats of firing Federal Reserve Chair Jerome Powell stirred up market volatility Monday, putting the Dow Jones Industrial Average on course for its worst April since 1932. Trump reiterated his demand the Fed cut interest rates, and blasted Powell.

Futures tied to all three major indexes rose. Nasdaq-100 futures led gains.

Treasury yields wavered. The 10-year rose above 4.41%, having settled Monday at 4.4%.

Gold futures surged above $3,500 a troy ounce before paring back somewhat.

The Cboe Volatility Index retreated to around 32. Wall Street’s “fear gauge” had jumped Monday.

Overseas stocks were mixed. European benchmarks mostly fell. Hong Kong’s Hang Seng Index rose 0.8%, while Japan’s Nikkei 225 ticked lower.

Companies reporting earnings early Tuesday include GE Aerospace, RTX and Lockheed Martin. Results are due from Tesla after the close. The stock slid nearly 6% Monday.

📧 Get smarter about markets with our free weekday morning and evening newsletters.