More pain appears to be in store for markets after their worst week to start a quarter since 2008. U.S. stock futures tumbled Sunday night when trading reopened, and markets in Asia plunged.

In the U.S., contracts tied to the tech-heavy Nasdaq-100 led the declines, down more than 3.5%. In Japan, the Nikkei 225 dropped 6% shortly after the open. Bitcoin and oil prices fell sharply, too.

Beyond the ebb and flow of daily trading, investors seeking out possible parallels to the trade war of 2025 are grappling with the lessons of the U.K. decision to leave the European Union.

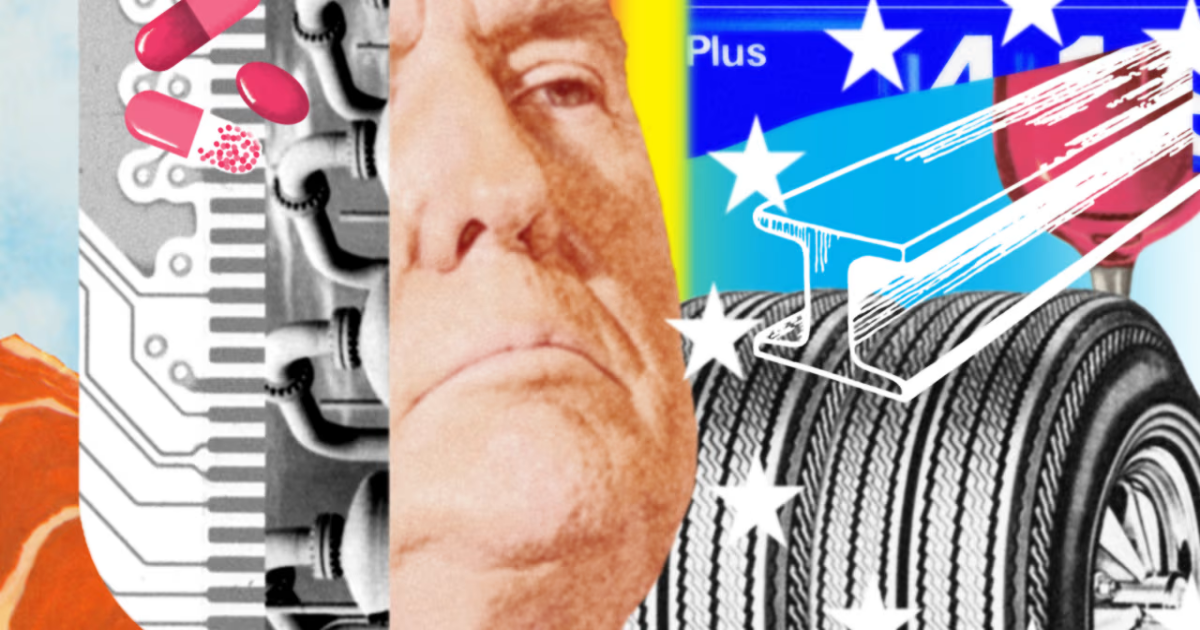

To recap: Tariffs on just about everything the U.S. imports took effect Saturday and are due to be raised on some countries on Wednesday. U.S. retailers are starting to talk with consumers about what the tariffs could mean for everyone’s wallets.

Trump, who was golfing in Florida over the weekend, urged Americans to stay the course through what he called an economic revolution, promising in a social-media post that “it won’t be easy, but the end result will be historic.”

Here’s what else you need to know:

Futures tied to the major U.S. indexes dropped more than 2.3%, paring earlier declines that were twice that deep. Investor sentiment has taken a hit in recent weeks and many on Wall Street will closely scrutinize major stock indexes, bond yields and gold prices.

Israeli Prime Minister Benjamin Netanyahu is set to be the first world leader to hold in-person talks with Trump about the tariffs.

Indonesia and Taiwan, each facing 32% levies on their products, are among the countries planning not to retaliate against the U.S.

British car maker Jaguar Land Rover will pause shipments of its luxury vehicles to the U.S. in the wake of the new tariffs.

First-quarter earnings will start rolling in this week, with reports due from Levi Strauss, Delta Air Lines and CarMax. Friday is likely to be the most eventful day, with JPMorgan Chase, Wells Fargo and BlackRock on deck.