Tom Espiner

Business reporter, BBC News

Getty Images

Getty Images

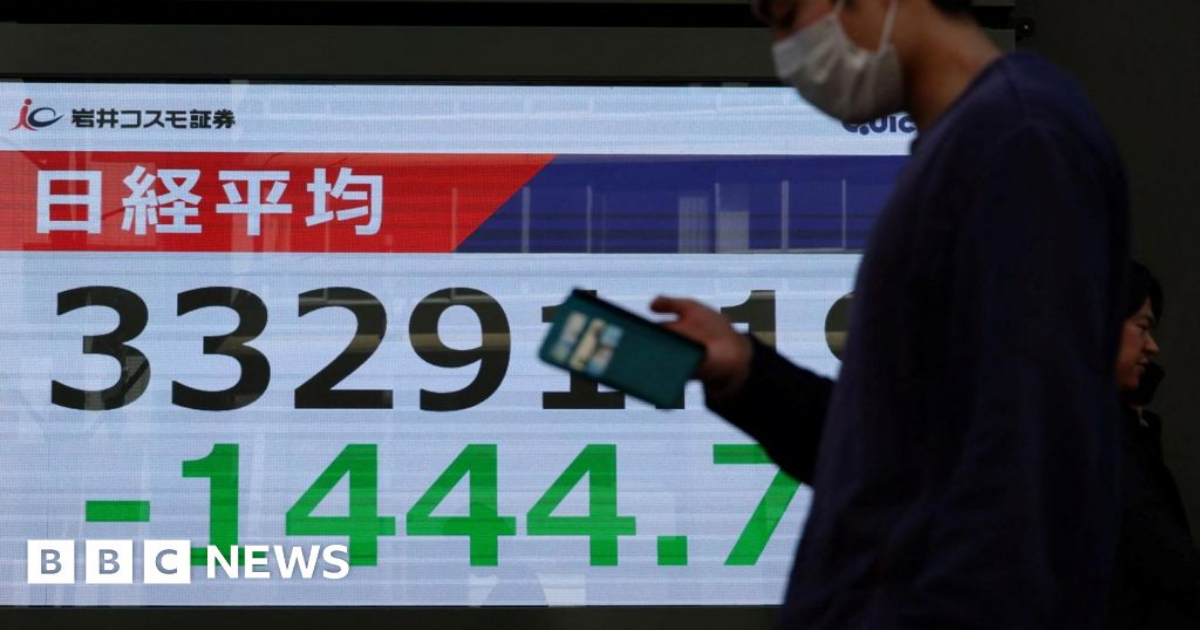

European markets have slumped further after China hit back at US import taxes with retaliatory tariffs of its own.

The UK’s FTSE 100 and Germany’s Dax dropped about 4%, with some companies seeing double-digit falls in their share prices.

The declines add to large falls seen on Thursday as markets continued to react to the uncertainty triggered by the US tariffs.

Traders are concerned the tariffs will increase prices and weigh on growth in the US and abroad.

The sweeping new tariffs announced by President Donald Trump triggered a slump in global stocks on Thursday, with US markets seeing their worst day since the impact of the Covid pandemic in 2020.

Trump told reporters he thought things were going “very well”, adding: “The markets are going to boom.”

But on Friday markets continued to slide, then dropped sharply after China imposed additional tariffs of 34% on all US goods from 10 April.

In London, shares in Barclays bank and NatWest were down more than 8%, mining firm Glencore fell more than 9% and aero-engine maker Rolls-Royce was down more than 9%.

Russ Mould, investment director at AJ Bell, said the “relentless selling” had continued despite investors “hoping the pain would go away”.

“There are so many moving parts that getting your head around the situation [as an investor] isn’t easy,” he said.

“With countless sectors set to be hit by tariffs, it’s difficult to know where to begin to comprehend the situation.”

Jane Sydenham, investment director at Rathbones, said banking stocks, firms with supply chains that were exposed to tariffs, and tech stocks had all been falling.

Investors had been buying into safe haven assets including gold and government bonds, she said.

China had been “under severe pressure” to respond to tariffs of 54% on most goods, she said, and its economy was big enough to be able to take such action.

But countries with smaller economies were having to be more cautious, she added.

Leah Fahy, China economist at Capital Economics, said the country had “hit back hard” against US tariffs.

She said the “aggressive, escalatory” response “makes a near-term deal to end the trade war between the two superpowers highly unlikely”.

The dollar index, which measures the value of the US currency against six peers, had sunk 1.9% on Thursday, the sharpest drop since November 2022, but on Friday it steadied, rising by 0.35%.

Oil prices fell sharply as traders worried that the tariffs could slow economic growth and worsen trade disputes.

The price of a barrel of Brent crude slumped more than 6% to $65.35 a barrel.

The managing director of the International Monetary Fund (IMF), Kristalina Georgieva, has said the new tariffs “clearly represent a significant risk to the global outlook at a time of sluggish growth”.

She said the IMF was still looking into the “macroeconomic implications” of the measures and stressed the need to avoid actions that could do more damage to the global economy.